What Does Boomer Benefits Reviews Do?

Wiki Article

About Medicare Part C Eligibility

Table of ContentsNot known Details About Boomer Benefits Reviews Get This Report about Medigap Cost Comparison Chart8 Simple Techniques For Apply For MedicareThe Best Guide To Aarp Plan GMedicare Supplement Plans Comparison Chart 2021 Pdf Fundamentals ExplainedBoomer Benefits Reviews Things To Know Before You Get This

Nelson does not require to file an application for Premium-Part A since he stays in a Component A Buy-in State. The FO refers Mr. Nelson to his State to submit for the QMB Program, according to guidelines in HI 00801. 140E.3 of this area. (Note: If Maryland authorizes Mr. Nelson's application for the QMB Program, the State will enroll him in State Buy-in because he already has Component B.

Review listed below to find out-- If he has Medicaid or QMB, exactly how much will Medicaid pay?!? SHORT RESPONSE: QMB or Medicaid will pay the Medicare coinsurance only in minimal scenarios.

The smart Trick of Medicare Part G That Nobody is Discussing

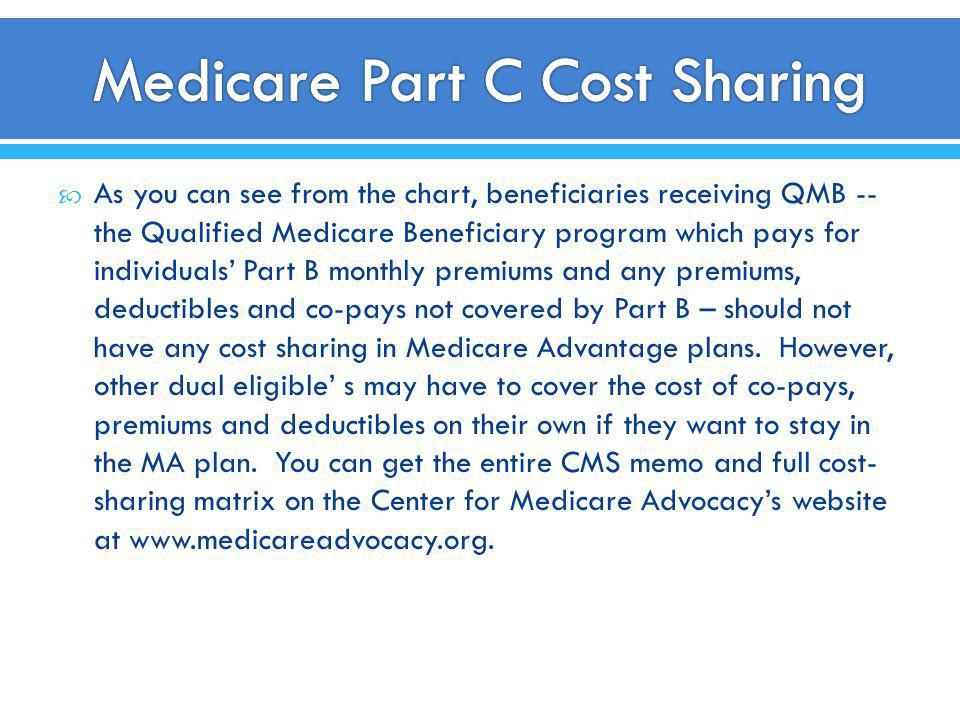

Unfortunately, this produces stress between a private as well as her doctors, drug stores giving Component B medications, and other companies. Providers may not recognize they are not permitted to bill a QMB recipient for Medicare coinsurance, because they bill various other Medicare recipients. Even those who understand may press their people to pay, or merely decrease to offer them.The company bills Medicaid - also if the QMB Recipient does not also have Medicaid. Medicaid is needed to pay the copyright for all Medicare Part An and also B cost-sharing charges for a QMB beneficiary, also if the solution is generally not covered by Medicaid (ie, chiropractic, podiatry and also medical social job care).

Cuomo has recommended to lower how much Medicaid pays for the Medicare expenses also better (medicare select plans). The amount Medicaid pays is different depending upon whether the person has Original Medicare or is a Medicare Advantage strategy, with better payment for those in Medicare Advantage plans. The response likewise differs based on the sort of service.

Not known Details About Medicare Supplement Plans Comparison Chart 2021

- - Currently, Medicaid pays the full Medicare authorized charges up until the recipient has actually met the annual insurance deductible, which is $198 in 2020. Dr. John charges $500 for a see, for which the Medicare approved cost is $198.

If the Medicaid rate for the same solution is just $80 or much less, Medicaid would certainly pay absolutely nothing, as it would certainly take into consideration the physician totally paid = the provider has actually obtained the complete Medicaid rate, which is lesser than the Medicare rate. s - Medicaid/QMB wil pay the full coinsurance for the following services, despite the Medicaid price: rescue as well as psychologists - The Gov's 2019 proposal to eliminate these exemptions was denied.

Medicare Part C Eligibility Can Be Fun For Anyone

Medicaid pays none of the coinsurance since the Medicaid price ($120) is reduced than the amount the supplier currently received from Medicare ($148). For both Medicare Benefit as well as Original Medicare, if the expense was for a, Medicaid would pay the complete 20% coinsurance no matter of the Medicaid rate.If the supplier desires Medicaid to pay the coinsurance, after that the copyright needs to register as a Medicaid copyright under the state guidelines. This is a change in policy in implementing Area 1902(n)( 3 )(B) of the Social Safety And Security Act (the Act), as customized by section 4714 of the Well Balanced Budget Plan Act of 1997, which forbids Medicare providers from balance-billing QMBs for Medicare cost-sharing.

This section of the Act is offered at: CMCS Educational Publication . QMBs have no lawful commitment to make additional repayment to a supplier or Medicare took care of treatment plan for Part A or Part B price sharing. Providers who wrongly costs QMBs for Medicare cost-sharing undergo assents. Please keep in mind that the law referenced above supersedes CMS State Medicaid Handbook, Chapter 3, Eligibility, 3490.

Everything about Apply For Medicare

CMS advised Medicare Advantage plans of the rule against Equilibrium Billing in the 2017 Telephone call Letter for plan revivals. See this excerpt of the 2017 phone call letter by Justice in Aging - It can be hard to show a copyright that a person is a QMB. It is specifically challenging for providers who are not Medicaid companies to determine QMB's, given that they do not have access to on the internet Medicaid qualification systems If a consumer reports a balance billng issue to this number, the Client service Associate can rise the complaint to the Medicare Administrative Professional (MAC), which will certainly send out a conformity letter to the service provider with a duplicate to the customer.50 of the $185 authorized rate, company will ideally not be hindered from offering Mary or various other QMBs/Medicaid receivers. - The 20% coinsurance is $37. Medicaid pays none of the coinsurance since the Medicaid rate ($120) is less than the amount the provider already received from Medicare ($148). For both Medicare Benefit and also Original Medicare, if the costs was for a, Medicaid would pay the full 20% coinsurance no matter the Medicaid price.

If the provider desires Medicaid to pay the coinsurance, after that the copyright has to register as a Medicaid service provider under the state rules. This is an adjustment in policy in implementing Section 1902(n)( 3 )(B) of the Social Security Act (the Act), as changed by section 4714 of the Balanced Spending Plan Act of 1997, which restricts Medicare carriers from balance-billing QMBs for Medicare cost-sharing.

The Only Guide to Apply For Medicare

This area of the Act is readily available at: CMCS Informational Notice . QMBs have no lawful responsibility to make more settlement to a company or Medicare took care of treatment plan for Component A or Component B cost sharing. Companies that wrongly costs QMBs for Medicare cost-sharing are subject to sanctions. Please note that reference the statute referenced over supersedes CMS State Medicaid Guidebook, Phase 3, Qualification, 3490.

Report this wiki page